The Egyptian pound is expected to further slump against the US dollar, crossing the 35-threshold throughout April, amid a notable activity of the hard currency in the parallel market, two experts told Business Monthly.

The Monetary Policy Committee (MPC) of the Central Bank of Egypt (CBE) raised last week key interest rates by 2% (200 bps) to 18.25%, 19.25%, 18.75%, and 18.75% for overnight deposit rate, overnight lending rate, main operation rate, and discount rate, respectively.

The action, which meant to curb the elevating inflation, came amid wide expectations that the CBE could introduce more devaluation to the Egyptian pound against the US dollar following the interest rates hike.

Since March 2022, when the war in Ukraine sparked, the Egyptian pound has lost over 70% of its value against the US dollar, as a bid taken by the CBE to make the local currency attractive for foreign investors with about $25 billion in hot money fled the local market. This caused a significant shortage of US dollar liquidity in the local market.

Meanwhile, Egypt is suffering a $17 billion financing gap through FY2025/2026, according to the International Monetary Fund (IMF) estimations.

The US dollar is currently trading for close to EGP 31 compared to a level of EGP 15 before the onset of the Russian-Ukrainian conflict.

The jump in US dollar price has raised the expenses ceiling in the coming FY2023/2024 to EGP 3 trillion, with a growth rate of 44.4%, according to the FY2023/24 draft budget by the finance ministry announced last week.

Speaking to Business Monthly, a banking expert and CEO of Raya Consulting, Hany Abou El-Fottouh, projected the Egyptian pound to depreciate against the US dollar and to trade for EGP 35-36 over the medium-term that extends through the MPC’s upcoming meeting scheduled on 18 May.

Under the IMF’s $3 billion Extended Fund Facility (EEF), Egypt has committed to adopting a flexible regime for both the interest rates and the foreign currency since the start of the loan program in December. Egypt is currently under the first review of this deal, which began on March 15.

Egypt has to fulfill its obligations to the IMF, Abou El-Fottouh explained, as well as raise the attractiveness of the local currency to encourage foreign investors to pump new investments in hard currency into the local market. This is in parallel to increasing the share of the private sector in the local economic activity to 65%, up from 30%.

Egypt set a list of 32 state-owned companies to be offered as investment opportunities, either under the government’s initial public offering program (IPO) or through assigning them to strategic investors, to tap them in accordance with the nine models of investments under the State Ownership Policy. According to the policy, models include concession contracts, build, operate, and transform (B.O.T) contracts, design, build, and operate (D.B.O) contracts, build, finance, operate, and transform (B.F.O.T) contracts, build, own, operate, and transform (B.O.O.T) contract, build, own, and operate (B.O.O) contracts, as well as performance contracts and management contracts, besides full privatization.

Easing monetary policy?

Since the Russian-Ukrainian war in February 2022, the pressure on the Egyptian pound intensified. The hot money fast exited emerging markets, confirming worries over the consequences of ultra-loose monetary policy.

International Markets Strategist at Naeem Holding, Alia Akram, told Business Monthly that the CBE is currently adopting an easing monetary policy leading to a further decline in the value of the local currency. This comes as a result of the increasing import bill amid the scarcity of foreign currency.

“The exchange rate is affected due to foreign currency shortages in banks. This shows in the wide gap between black market rates and official rates,” Akram said.

She expected the Egyptian pound to decline further on the black market, suggesting that last year’s halving of the official price is still not enough. “The CBE may have to lower it further,” she added. “Given that the 12-month non-delivery forward NDF rate is now above EGP 40 per 1 US dollar, it is only a matter of time before another major pound depreciation occurs.”

She added that along with CBE’s first rate hike in 2023,

The Egyptian pound is trading at EGP 35.5-36 per 1 US dollar in the parallel market, compared to an official rate of EGP 30.90 at banks.

“I highly suggest that the local currency may cross the 35-threshold against the US dollar throughout April till the upcoming monetary policy decision, “Akram forecasted.

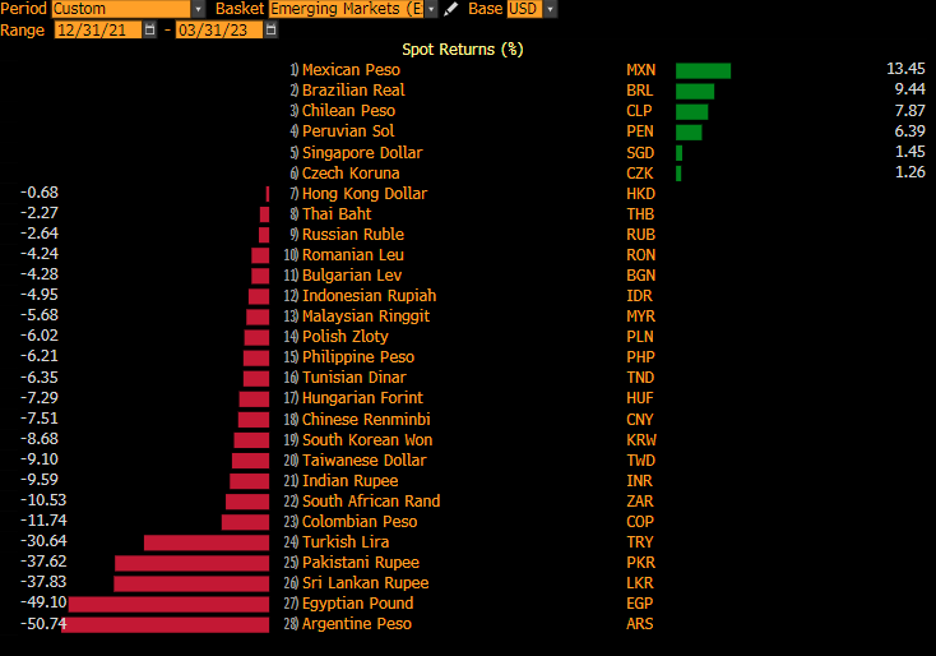

(The table below is provided by Naeem Holdings. It displays how much currencies in emerging markets have shed against the US dollar in the period between 31/12/2021 to 31/3/2023.)