Egypt holds the record for the highest number of hydrogen projects in the Middle East and North Africa with nine upcoming plants, half of which are green hydrogen projects, the government’s Information and Decision Support Center (IDSC) revealed, citing the Organization of the Petroleum Exporting Countries (OPEC).

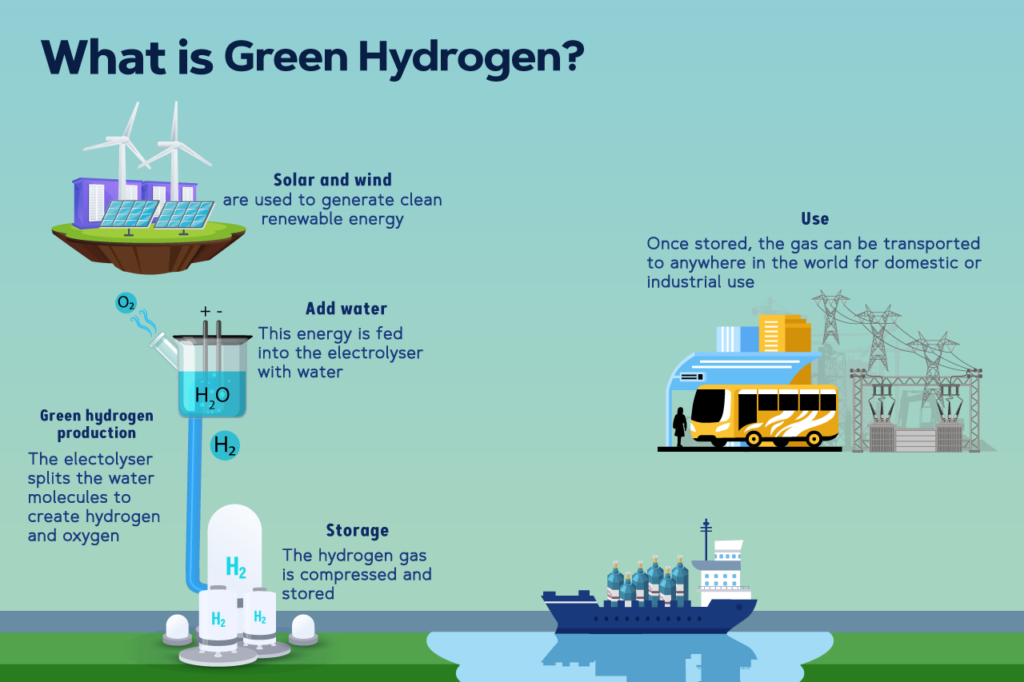

Green hydrogen is hydrogen obtained by splitting water using electrolysis. This process produces hydrogen as a stand-alone element, later harnessed as energy, and oxygen, dispersed into the air. Green hydrogen is an alternative to non-renewable fuel resources that exacerbates climate change by emitting CO2 and greenhouse gasses, whereas hydrogen emits water.

As part of the Infrastructure and Utilities Subfund, the Sovereign Wealth Fund of Egypt (TSFE) intends to launch a platform providing financial investors exclusive access to Egypt’s green hydrogen value chain. Green hydrogen is a fuel substitute in various industries like ammonia and methanol production plants and oil refineries. Due to its cost efficiency relative to other low carbon alternatives and traditional fuels, green hydrogen has the potential to be used in steel and aluminum manufacturing.

The Sovereign Fund of Egypt, established in 2018, intends to encourage private investments in Egypt and promote and co-invest in state-owned assets to optimize their cost-effectiveness for the Egyptian economy. The Infrastructure and Utilities Subfund seeks to address challenges in four key areas through a clear merit-based investing strategy: convertible electricity, renewable energy, logistics management, treatment plants, and digital infrastructure.

“Sustainability is not only around resource sustainability. In our book, resource sustainability is one sliver of the model. The other part of it is the economic system. So, financial feasibility, robust business models, robust contracts of partnerships, and governance,” says CEO Ayman Soliman during the U.S. GreenTech Business Mission to Egypt.

The mission took place May 14-17 in collaboration with the American Chamber of Commerce in Egypt (AmCham Egypt,) the U.S Chamber of Commerce, and the Office of the U.S Special Presidential Envoy for Climate. The delegation, which included American investors, public officials, eco-friendly funders, and technology companies, met with Egyptian companies and government officials to discuss partnership and financing opportunities in various industries, including energy, healthcare, agriculture, aviation, construction, and water management.

Untapped potential

Green hydrogen is a vital part of any decarbonization effort in Egypt. Decarbonization is a strategic shift in many emerging economies that are spending heavily on green hydrogen and securing long-term importers, according to the World Bank and Energy Sector Management Assistance Program’s 2020 report. The report reveals that leveraging eco-friendly fuel to produce higher-value exports will open new avenues for industrial expansion in emerging economies, particularly those with abundant renewable energy sources.

The Egyptian government is building power-to-X plants (P2X)- plants that convert renewable energy to a variety of energy carriers, processes, products, or raw materials- to facilitate the transition toward green energy. Egypt is focusing on power-to-water desalination and power-to-water processes with a mission to localize the technology to secure a sustainable water resource flow, Soliman highlights.

Accordingly, this presents a plethora of investment partnership avenues in Egypt throughout the energy streams, the CEO says. Egypt is on-demand on the wind and solar front of renewable energy, and when paired with its current water desalination technology, the country has excellent potential to become an industry leader in green hydrogen, therefore increasing its midstream energy portfolio, he highlights.

“It’s not only developers and strategy players that want to come into the upstream part, creating a renewable [energy] be it wind and solar, or the downstream and the off-takers of the green fuel offering bulking services or fueling their shipping fee,” Soliman explains, “It is also a partnership in key financial investment players sitting behind technology partners that will calve them to all.”

Green hydrogen projects amount to a total investment size of $67 billion, over half of which will go into phase one, according to an exclusive presentation provided by TSFE to AmCham Egypt. This investment aims to establish six green hydrogen projects that will create 16.7 GW of renewable energy. Offerings will begin in the fourth quarter of 2022.

Egypt is still discovering new ways it could deploy eco-friendly fuel as the use of green hydrogen is so novel to the world, Soliman said.

The country is looking into products that deploy green hydrogen and ammonia, and precisely shipping vessels. Soliman mentions that while there are currently no hydrogen-powered shipping vessels in the market, the fund targets investors who want to create such cadets. “We are looking at the eight-year curve…at what the capital trading market of those travel cadets will look like and how we can participate,” he adds.