Eyes are on the new Central Bank of Egypt (CBE) governor, Hassan Abdalla, as he tries to repair an economy thrown off course by an overvalued currency, soaring inflation and a banking system facing a shortage of foreign currency.

Last month, Egypt’s President Abdel Fattah al Sisi appointed Abdalla the CBE’s acting governor, succeeding Tarek Amer who resigned after seven years of leading the country’s monetary policy. The president directed Abdalla to develop a policy that will keep pace with global economic changes, diversify the sources of foreign currency and create an attractive climate for investment.

Abdalla brings extensive economic and banking experience to his new post. He was managing director of Cairo-based Arab African International Bank from 2002 to 2018. He sat on the board of the central bank, the Egyptian Exchange, the Institute of International Finance, the Communications Ministry’s ITIDA, and several private and public sector companies in Egypt.

Shifting policies

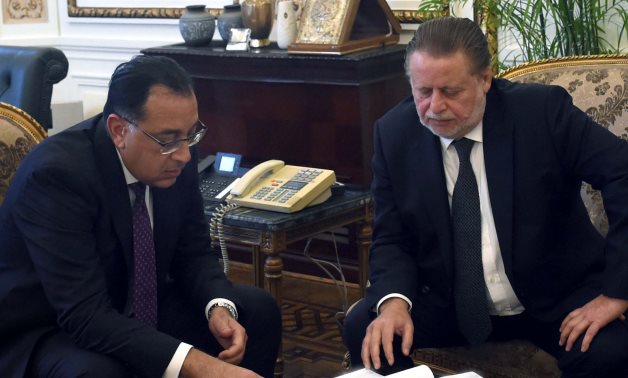

The government is working with Abdalla to develop new monetary and economic policies, set to be announced soon, Egypt’s Prime Minister Mostafa Madbouly said in August.

“ COVID-19’s impacts followed by the Russian-Ukrainian war is driving a need to shift the country’s monetary policy to control cash supply and maintain key interest rates to curb inflation,” CEO of Alraya Consulting Hany Abo El-Fotouh told Business Monthly.

Abo El-Fotouh stressed that CBE cannot restrain the rising inflation alone by tightening monetary policy. This has to be coupled with government efforts to apply structural reforms to its fiscal policy, he added.

“Monetary policy targets lowering demand, while fiscal policy is meant to control the supply through increasing production and offering more commodities and services. Both policies are designed to stifle the soaring inflation,” Abo El-Fotouh explained.

The CBE kept overnight interest rates steady at its August 18 monetary policy meeting, hours after Abdalla was appointed. The next meeting is scheduled for September 22, a day after the U.S. Federal Reserve’s next meeting. Analysts expect the Federal Reserve to hike benchmark interest rates by another 0.75% (75 basis points).

“Egypt’s monetary policy is surrounded by unprecedented challenges. Some $35 billion in indirect investments fled the local market in 2020 and 2021 because of raising the key interest rates while keeping the exchange rate unchanged. Key interest rates must be directly linked to the exchange rate,” Chairman of the International Investors Group Hani Tawfik told Business Monthly.

Last week, Minister of Finance Mohamed Maait said that a total of $22 billion in hot money (funds controlled by investors seeking short-term returns) invested in local debt instruments have exited the market, driven by the rising interest rates in the U.S. and uncertainty from the war in Ukraine.

However, Tawfik noted he is optimistic about Abdalla’s leadership, given his extensive economic background. He expects the CBE to hike interest rates by up to 2% through the end of 2022 and to devalue the Egyptian pound by a further 1.5% to curb inflation.

Since March, the CBE has hiked key interest rates by a total of 3% and devalued the Egyptian pound against the U.S. dollar by over 20%.

Days after Abdalla’s appointment, he appointed former chairman of the Commercial International Bank (CIB) Hisham Ezz El-Arab and former board member of SAIB bank Mohamed Naguib as his advisors. The CBE also removed caps on bank deposits and withdrawals by firms and individuals, imposed during the pandemic days after. It raised the daily withdrawal limit to EGP 150,000, up from EGP 100,000, from bank branches and EGP 20,000 from ATMs.

Forex liquidity

Abdalla’s appointment comes as Egypt negotiates with the International Monetary Fund (IMF) on a new loan. The government asked for the fund’s support in March amid the economic shocks of the Russia-Ukraine war, and in August, Madbouly announced that Egypt is in the final stages of the loan deal.

The fund said in July that the government still needed to make “decisive progress” on fiscal and structural reform.

Ahmed Shawky, an expert with over 20 years of banking experience, told Business Monthly that preserving the gains of the economic reform program, particularly maintaining the stability of the Egyptian pound against the U.S. dollar, is the most pressing challenge the new governor has inherited.

“Other challenges include ensuring foreign reserves cover five months of the country’s staple needs and extending facilities to the small- and medium-sized enterprises (SMEs),” Shawky added.

Shawky noted that the CBE is not responsible for providing hard currency to the local market. The central bank is only required to preserve net international reserves (NIR), which include gold and hard currencies generated by economic activities like tourism and the Suez Canal.

“This means that the key mission of monetary policy is to keep the stability of prices in the local market. The CBE mediates between the country and other countries across the world to attract hard currencies, which are reflected in its NIR,” Shawky explained.

According to the latest figures from the CBE, Egypt’s NIR stood at $33.1 billion in July, down from $40.93 billion at the end of December 2021 as a result of the war in Ukraine. The reserves cover 4.7 months of Egypt’s imports.