As with many sectors in 2023, infrastructure development is seen by international investors as on the threshold of an unprecedented transformation. This year may represent “an epoch unlike any other,” said a KPMG report titled Emerging Trends in Infrastructure, 2023 Edition. “Future generations may look back at 2023 with deep admiration or deep scorn,” it said

Driving that transformation is not technology but decisions by government officials and businesses. Future generations “may praise leaders for their foresight or damn them for their inactions,” KPMG’s report said.

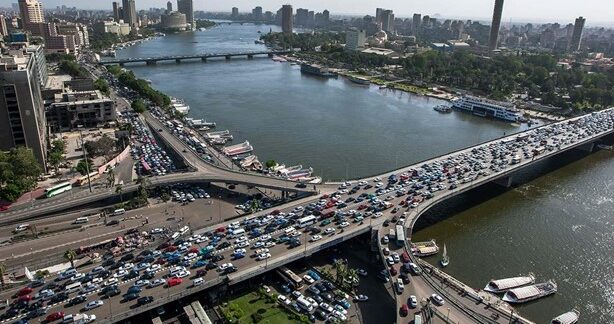

Attracting international infrastructure investment is vital for Egypt. In November, Minister of Planning Hala El-Said told the media the country had spent $400 billion on infrastructure projects since 2015. Investments jumped 340% in fiscal year 2020/2021 compared to 2015/2016.

Projects included building 7,000 kilometers (4,350 miles) of roads, tunnels and bridges between 2015 and 2021, a new capital city, 15 fourth-generation cities, and logistics facilities highlighted by the new Suez Canal. In addition, the government is upgrading the country’s digital infrastructure to fuel the economy’s digital transformation.

El-Said said the government also developed a “convenient infrastructure and legislative environment” to attract private investment, citing the Sovereign Fund of Egypt.”

However, the key to the government’s success likely will be understanding and catering to the new trends affecting global infrastructure investments.

Global forces

The KPMG report said that in 2023, geopolitical uncertainty and the new realities it creates would play a significant role in attracting infrastructure FDI. “The foundations of globalization are eroding,” it said. “Protectionism is rising. Populism is turning into unilateralism. And the ties that have bound the old geopolitical world are weakening.”

The KPMG report said cross-border infrastructure investments would likely be the sector least affected by geopolitical tensions. “Everyone agrees on the need for new and improved infrastructure.” It is “one of the few things governments provide their citizens that they can actually see, touch and use.”

However, attracting infrastructure FDI in the current climate could be more complicated than usual. “The fracturing and shift to continuously shifting allegiances [creates] complexity,” the report said. That includes unpredictable costs, prices, and regulatory changes.

Implications for global infrastructure companies could prove “massive.” On the ground, geopolitical considerations would determine which countries they invest in. “Work with the wrong parties, and you could find yourself blacklisted by other parties.” Additionally, countries could impose new laws and regulations requiring unprecedented transparency and disclosures from foreign investors.

KPMG said decisions by the U.S. administration could single-handedly determine the future of domestic and cross-border infrastructure investments. “Did Janet Yellen [ U.S. treasury secretary] ring the death knell on globalization [by] calling on companies and governments to rethink their global supply chains and trade flows to prioritize allies and trusted partners?”

Adding more complications, allegiances might change based on each nation’s agenda, priorities and interests, and infrastructure projects take years to build and finance. “Organizing around cost was fairly straightforward; organizing around the strength of one market’s relationship to another is more challenging. There may be no simple decisions.”

The KPMG report predicted global events would impact infrastructure companies’ strategies in 2023 and beyond. “Expect to see infrastructure players start to rework their supply chains … And don’t be surprised to see some significant fallout as less-friendly markets and companies get dropped.”

Environment, environment

Running parallel to geopolitical uncertainty is the inevitability of making new infrastructure projects eco-friendly while “greening” existing infrastructure. “Timelines have shrunk. The potential impacts of climate change are no longer someone else’s problem.”

The focus will be on infrastructure projects that help adaptation as “people come to terms with what it means to live in a climate-stressed world.” That will create a new challenge for governments and investors. Their approaches need to help solve the “trilemma of security, affordability, and sustainability at pace.”

However, those divergent needs will create new opportunities in infrastructure for “cleaner fuels, abatement and energy efficiency … along with innovations in new green technologies, like green hydrogen.”

One major challenge facing “green” infrastructure investors will likely be the disparity between government talk and action. “Governments — having stated lofty goals and attended high profile conferences — have been maddingly slow to move their feet.” Their main concern is the “cost of the transition and who is going to fund it.”

Another factor that will play a significant role in infrastructure investments this year will be investors’ priorities. “Institutional investors command some $100 trillion in assets under management … From a pure capital perspective, it’s clear the money is there,” the report said. However, they have stringent investment requirements. They are long-term investors that” understand the long-term effects of climate change and are invested enough to want to do something about it.”

If governments “are not actively decarbonizing, [they risk] some asset managers raising the cost capital.” Others may pull out completely. Throughout 2023 and beyond, “institutional investors, governments, and owners [will] become much more comfortable allowing the power of capital to drive climate outcomes.”

The report also sees “sustainability” becoming more formalized as a fundamental prerequisite for all new infrastructure development.” That means infrastructure investors will “start to think not just about financial budgets, but also about carbon allocation ones.”

Localization

The KPMG report noted the effects of domestic economic factors in determining whether international infrastructure investors consider one country over another.

Inflation tops the list. “We are seeing infrastructure planners and owners struggling to budget for projects that will take years to deliver and decades to finance.” Such investors will find their “return on investments … rapidly changing [with] rising costs.”

“For years, costs have remained stable and price risk was generally considered a symptom of poor cost management.” That is no longer the case, as “the link between risk and discipline has become unhinged,” KPMG said. “No amount of cost or price discipline can protect margins during … inflationary shocks, supply constraints, and volatile commodity prices.”

The key to attracting infrastructure FDI is to accept there will be a “rethink [of] who should … own the cost and price risk [of infrastructure] assets and investments.” The second factor is there must be “strong trust and cooperation between public and private sectors, owners and contractors, developers and operators, and buyers and suppliers.”

A city’s resources, requirements and future demands also could determine if investors commit to projects. “Even before the pandemic struck, city leaders knew they were in tight competition for resources, investment, and talent.” Major cities have lost their “magnetism” in favor of newer, less populated, and better-planned metropolises with built-in digital and entertainment infrastructures.

That means more investment in high-tech infrastructure and attracting investors who can meet those needs. That ultimately results in higher investment costs. A case in point is that infrastructure when building “smart cities” is significantly costlier, more complex, and technology-dependent.

The KPMG report said demand for high-tech infrastructure is more prevalent in emerging economies, as they are building new cities with greenfield infrastructure rather than attempting to upgrade legacy brownfield ones in existing cities. One reason that justifies the feasibility of building new metropolises in those economies is “brownfield infrastructure is notoriously difficult to digitize. The business case doesn’t always stack up.”

The key to successfully upgrading and greening brownfield infrastructure is determining who is “willing to pay for it and whether the [government] can offer the right incentives … to encourage it.” Another major factor is having the “right skills and experience” to manage those upgraded facilities.

Another rising trend is “customized infrastructure.” It is where infrastructure investors customize their projects to meet specific and evolving social demands. “In the past, infrastructure was all about building monolithic [facilities] where people could receive standard service,” the report said. They include healthcare facilities, schools and mass transit. That is changing thanks to the advent of technology, which opens the door to new options, such as ride-sharing, and choosing between online and in-person education programs. However, “there may be massive opportunities for the private sector” as each city can have different investment options for infrastructure developers.

KPMG says such customization affects physical assets and how residents use them. The challenge is governments are not on the same page as citizens. “The problem is that this [transformation] is happening despite existing infrastructure and policy, not because of it.” That is evident as the “shift is being driven by private players who have spotted a need in the market.”

Human element

A significant challenge in most countries is decision-makers are usually reluctant to shift or upgrade a country’s infrastructure.

The report explained, “Infrastructure assets are expensive, … made to last for decades. So there is an obvious reluctance to abandon them early.” Complicating matters is “humans are sentimental creatures” who don’t like to abandon assets, even if the new ones are better. The “obsession with sunk costs … and abandoned assets … is slowing the ability to transform.”

That creates a new type of problem that will get harder to solve with time. “The potential risks of trying to solve new problems within an old context and mindset are huge,” KMPG said. “It limits imagination, … stifles innovation, … slows investment from flowing into new ideas and technologies, … increases costs, encourages waste and creates redundancy.” Ultimately, that prevents the move to customized infrastructure, which could deter international investors who use the latest infrastructure innovations and solutions.

Changing the mindset of decision-makers is paramount. A case in point is EVs. People criticize them because their production is not yet environmentally friendly, the raw materials they need (rare earth minerals like lithium and cobalt) are not sustainable, and the electricity they consume still comes mostly from nonrenewable fossil fuels. “Perhaps the better question is, do we still need to own cars to move around?”

Alternatively, policymakers and investors could “pour more capital into [existing infrastructure], incrementally improving its footprint until it … falls within parameters.” That would avoid the need to change decision-makers’ mindsets regarding sunk costs and abandoned assets. However, it would “require” a mindset change to allow for “new ways of thinking and new approaches to financing, funding, and regulation.”

Regardless of a government’s approach to attracting infrastructure FDI, it must change its thinking. “The willingness to let go of the past may largely dictate how societies move into the future,” the KPMG report said. “They won’t innovate if they can’t open their minds to new ideas and approaches. They won’t adapt if they aren’t looking ahead.”