Middle Eastern countries mainly Egypt, Lebanon, and Jordan, are expected to be impacted severely by the escalation of the Israel-Palestine war, with Egypt projected to lose up to 30% of its tourism receipts, S&P Global said in a report.

As immediate neighbors of Israel and Gaza, Egypt, Jordan, and Lebanon are more vulnerable to a slowdown in tourism, given concerns about security risks, social unrest, and high external vulnerabilities, according to the report.

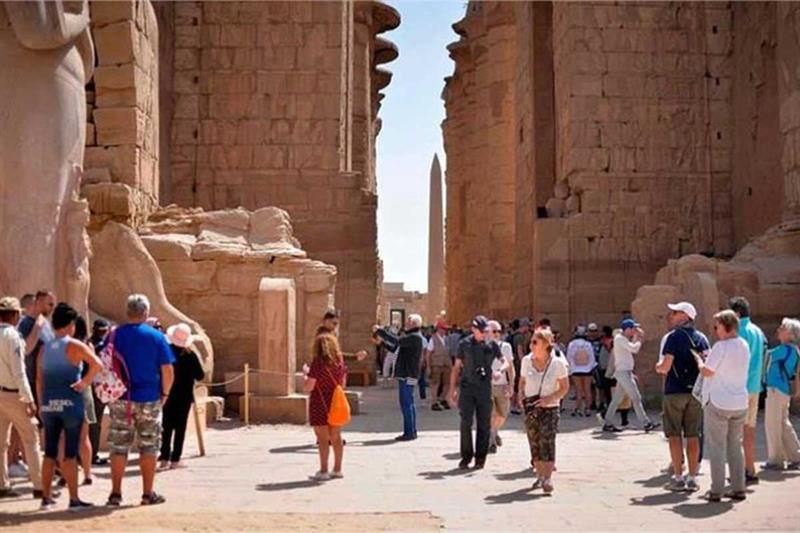

Egypt’s tourism

Loss of tourism revenue of 10%-30% could cost Egypt 4%-11% of foreign exchange reserves if the Central Bank of Egypt (CBE) were to intervene in the foreign exchange market, the report projected.

Egypt’s tourism sector contributes 12%-26% of the current account receipts of three countries, generating foreign exchange income as well as employment, S&P said. The sector directly employs approximately 10% of the Egyptian population.

Tourism receipts increased in Egypt by 30% during the first half of 2023 and were at record-high levels over the 12 months to 30 June, said the report.

“Since the war between Israel and Hamas, several tour agencies in Egypt have reported cancellations of around half of the bookings for November and December, particularly from European travelers. Airlines such as Lufthansa, Eurowings, and Swiss Air suspended flights to Lebanon in mid-October. We think similar trends could emerge in Jordan’s tourism sector,” the report noted.

“We see Egypt as being in a more vulnerable situation than Jordan despite a lower economic concentration in tourism,” the report further added. The report attributed that to the sector’s revenue shortfalls that is expected to weigh more on the country’s external position amid large external debt repayments coming due.

Egypt’s net international reserves (NIRs) have been improving slowly since being hit severely owing to the impacts of the war in Ukraine. In October, Egypt’s NIRs reached its highest in more than 18 months to $35.1 billion. Yet, the hard currency reserves declined by almost 2.5% in October compared to a month earlier, according to the latest data published by the CBE.

Accordingly, the report expected multi- and bilateral donors will continue to support Egypt and Jordan since instability in these countries could spill over to the rest of the region.

“It is important to emphasize the quite large share of visitors from the region and diaspora in total tourism arrivals, which should help shield the sector from a larger sector shock,” the report pointed out.

In Egypt’s case, the market’s reliance on arrivals from Western Europe, including the UK, is higher, and sunshine-seeking visitors including those on package holidays may have no preference for specific destinations.

Ambitious plans

Egypt’s Tourism Minister Ahmed Issa stated on November 6 that Egypt received 1.3 million tourists from 80 countries in October, a rise of 8% compared to October 2022, despite the geopolitical crunch.

Issa also stressed that Egypt insists on reaching the goal it set of attracting 15 million tourists in 2023, adding that the ministry has a plan to add 25,000 new hotel rooms by mid-2024 and raise the number of tourists to 30 million by 2028.

To address the severe US dollar shortage the country has faced since March 2022, the government announced in July a plan to generate $191 billion by 2026, with 17% anticipated to come from the tourism sector.