In Egypt, women entrepreneurs confront a challenging business environment, with 77% resorting to personal savings and 45% depending on friends and family for financial support, according to a recent survey by global e-payment solutions provider Visa.

This survey coincides with the third iteration of Visa’s global She’s Next grant program in Egypt, launched in collaboration with the Commercial International Bank Egypt (CIB).

“Women entrepreneurs face unique challenges such as limited access to capital, lack of mentorship, and dealing with gender stereotyping concerns where they are considered less capable of handling high-pressure situations. Access to these factors, along with a robust digital infrastructure, is critical for women entrepreneurs to flourish and scale up their businesses,” said Malak El Baba, country manager for Egypt at Visa.

In an effort to empower women entrepreneurs across various industries in Egypt, the She’s Next program offers women the opportunity to apply for grants, with three winners receiving $10,000 each. Additionally, five finalists will gain access to a one-year mentorship program, while the top twenty applicants will participate in a one-year capacity-building program facilitated by USAID.

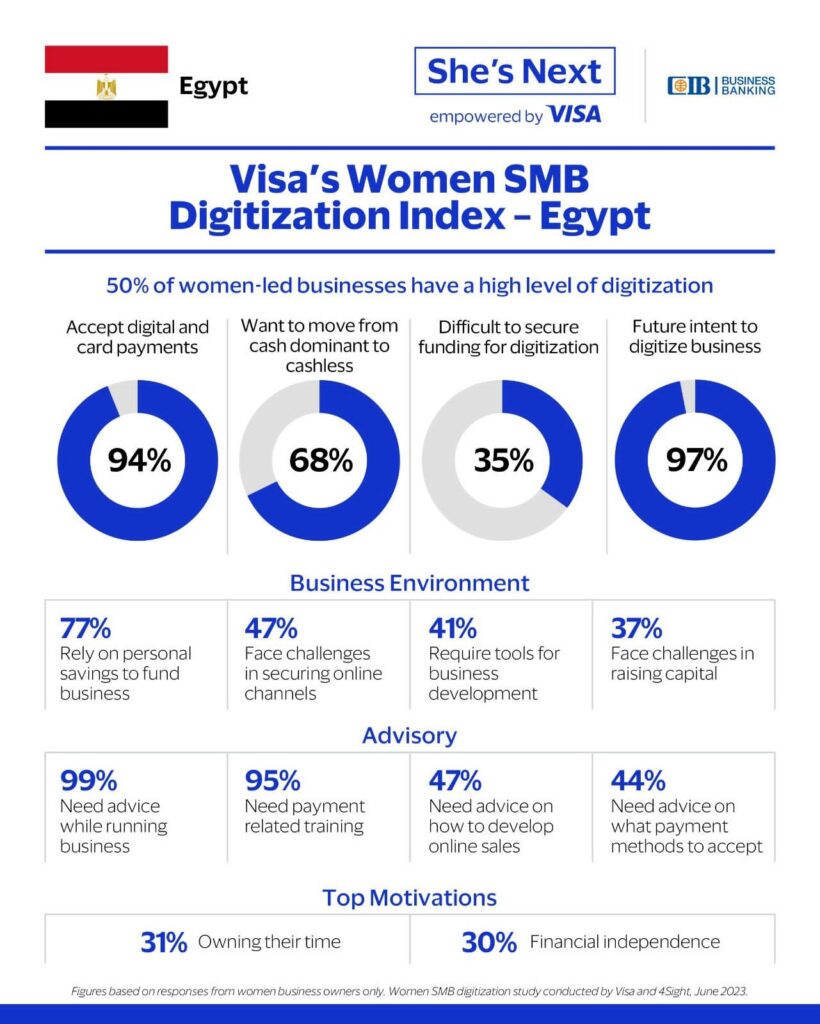

According to the survey’s results, Egyptian women are motivated to start their businesses, with 31% emphasizing time management and 30% emphasizing financial independence as key driving factors.The survey also highlights the strong desire among Egyptian female entrepreneurs to seek guidance from their peers, with approximately 99% of respondents expressing the need for advice and specific assistance in overcoming business challenges (50%), developing online sales strategies (47%), and building effective teams (33%). Additionally, 95% of women entrepreneurs are interested in payment-related training, while 44% are looking for advice on customer-preferred payment methods.

She’s Next is a vital component of Visa’s commitment to supporting the digitalization of women-owned businesses. It includes the introduction of Visa’s inaugural Women SMB Digitalization Index, which assesses businesses based on five key indicators: online presence, digital payments, payment security, customer engagement, and customer retention.

Since 2020, Visa has invested nearly $3 million in providing over 250 grants and coaching opportunities to small and medium-sized women-led businesses through its She’s Next program globally, spanning countries such as the United States, Canada, India, Ireland, Ukraine, Kazakhstan, Saudi Arabia, the UAE, Egypt, and Morocco.

The survey also revealed that 7 in 10 women entrepreneurs consider themselves to be digitally savvy, with 97% planning to digitalize their businesses by incorporating artificial intelligence (AI), automation technologies, digital marketing, analytics tools for insights, leadership training, and software implementation. Notably, these women are eager to transition to cashless operations using digitalization. However, around 35% of respondents found securing funding for this digitalization process to be challenging.

Infographic provided by Visa.