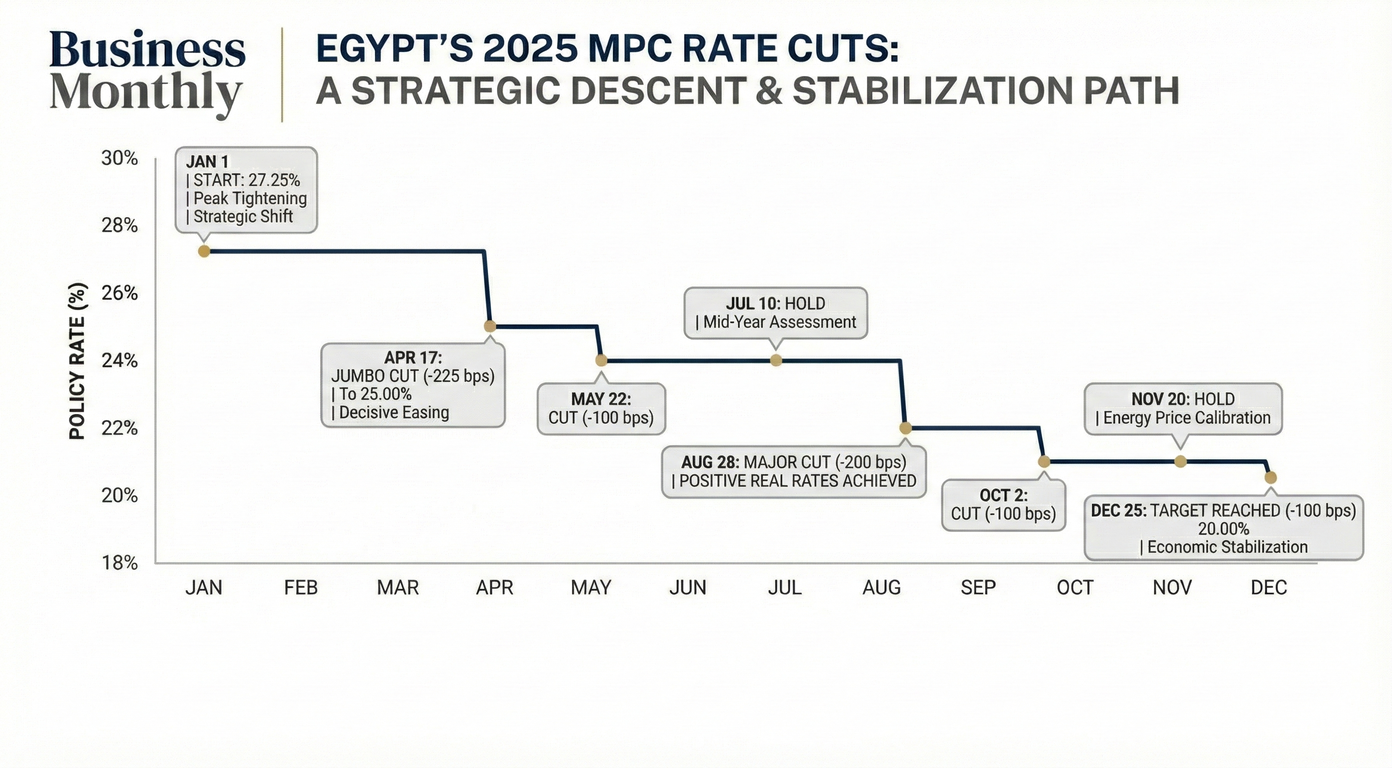

Egypt’s central bank has initiated its long-anticipated easing cycle with a 100 basis point rate cut, but policymakers and analysts agree that further reductions will be gradual and highly sensitive to both domestic inflation trends and external risks.

The Central Bank of Egypt (CBE) cut the overnight deposit rate to 20 percent, the overnight lending rate to 21 percent, and the main operation and discount rates to 20.5 percent. The move marks the first rate reduction in nearly two years, following an extended tightening cycle aimed at restoring macroeconomic and financial stability.

Real rates are still doing the heavy lifting

Despite the cut, monetary conditions remain firmly restrictive. With inflation easing but still in the low teens, real interest rates remain positive, an outcome the CBE views as essential to sustaining portfolio inflows and protecting exchange rate stability.

A one percent cut was highly expected, said Ahmed Moaty, Financial Markets and Investment Expert and Executive Director at VI Markets Egypt, noting that he had flagged the move before the MPC decision. Even after this move, real interest rates remain elevated, which gives the central bank room to support activity without undermining market confidence.

Moaty described the decision as one of sequencing rather than stimulus, reflecting policymakers’ preference for credibility over front-loaded easing.

Why will the pace stay measured?

While headline inflation has moderated, core and services inflation remain sticky, reinforcing the CBE’s cautious tone. Officials have repeatedly stressed that future decisions will remain data-dependent and conditional on the balance of risks.

An analytical brief by the El Adl Center for Public Policy Studies characterised the move as measured normalisation, arguing that it supports recovery while preserving attractive real returns for investors. The centre warned that deeper or faster cuts would require stronger confidence in the durability of disinflation and the sustainability of external financing.

External risks still loom large

Analysts also point to external developments as a key constraint on the easing path. Heightened geopolitical tensions, including uncertainty following expanded US intervention in Venezuela, have raised concerns over global risk sentiment and potential volatility in energy markets. Such shocks could translate into higher risk premiums and renewed pressure on emerging market capital flows.

2026 outlook easing, but on Egypt’s terms

Looking ahead, analysts broadly expect 2026 to deliver meaningful but disciplined monetary easing.

Aya Zohair, Research Section Head at Zilla Capital, expects cumulative rate cuts of 600 to 700 basis points over 2026, with limited easing in the first half of the year and a faster pace of cuts in the second half once inflation risks ease.

Under this scenario, the overnight deposit rate could fall from around 20 percent to the 13 to 14 percent range by the end of 2026, while still maintaining positive real interest rates.

What lower rates mean for the private sector

Randa Hamed, Managing Director and Board Member at Okaz Asset Management, expects a similar endpoint for rates and argues that cheaper financing will allow private firms to expand more rapidly, achieve economies of scale, and reduce unit costs.

She stressed that the government cannot structurally continue to support an economic model centred on high returns from bank deposits and government debt instruments. As yields decline, a gradual shift toward equities and market-based investment vehicles becomes necessary.

Egypt’s stock market currently has around 220 listed companies, highlighting the need for deeper capital markets to absorb this transition sustainably.

Bottom line

Egypt has likely passed the peak of monetary tightness, but the easing cycle will be gradual, data-driven, and reversible. For businesses, this means a slow decline in borrowing costs. For investors, it signals a structural shift toward private sector growth and capital market development.